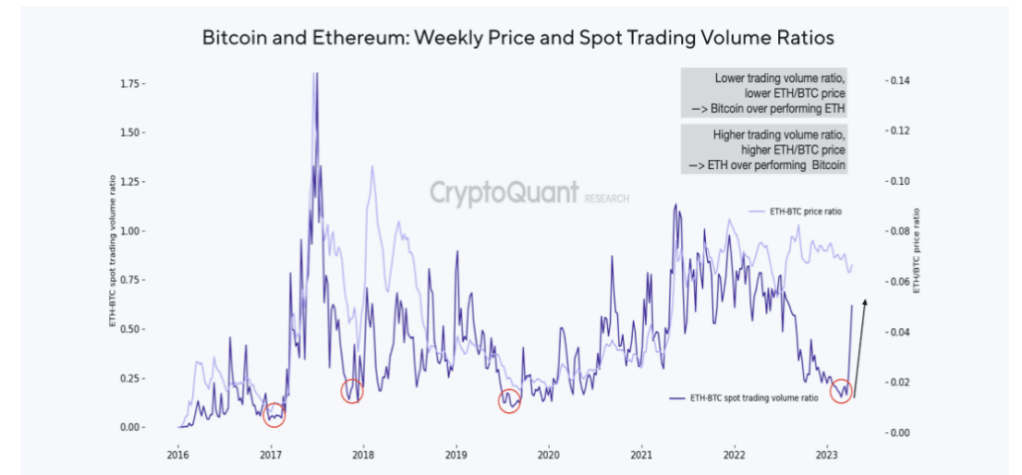

Bitcoin has demonstrated a more robust performance compared to ETH, with a 14% lead in 2023. This has been evidenced by the ETH/BTC price declining to the lowest point since July 2022. Nevertheless, there is a possibility that ETH may outperform BTC in the near future for two key reasons. Firstly, the relative spot demand for ETH has increased recently due to a decrease in BTC spot trading volume, following the suspension of zero-fee trading for most of its BTC trading pairs by Binance in March. Secondly, futures markets are indicating a potential shift towards ETH, with the open interest and trading volume possibly bottoming out. The uptick in ETH-BTC relative spot trading volume has been driven by the substantial decline in Bitcoin’s spot trading volume following the suspension of zero-fee trading by Binance. Additionally, there are indications that ETH will outperform BTC in futures markets. The ETH-BTC open interest ratio appears to have bottomed out before the Shanghai upgrade on April 12, indicating relatively higher demand for ETH than BTC. Furthermore, the perpetual futures market trading volume also shows that the ETH-BTC relative volume may have reached its lowest point, which could support an increase in ETH’s price in the future. However, it is important to note that ETH is still experiencing a downward trend against BTC from a valuation perspective, as the ETH/BTC MVRV ratio remains below its 365-day moving average.